Form Online Profit and Loss free printable template

Fill out, sign, and share forms from a single PDF platform

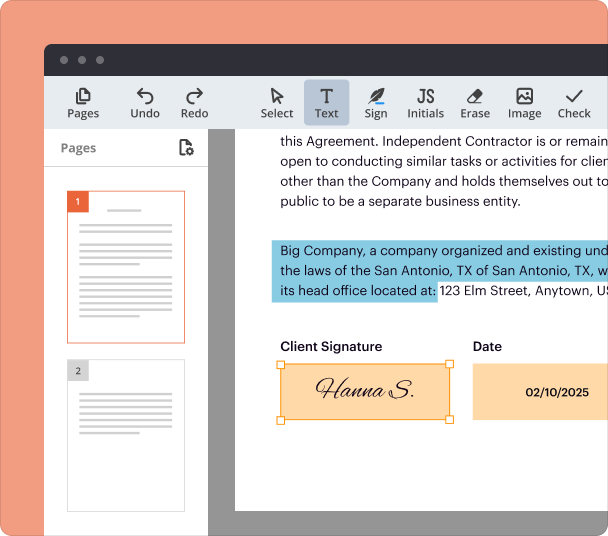

Edit and sign in one place

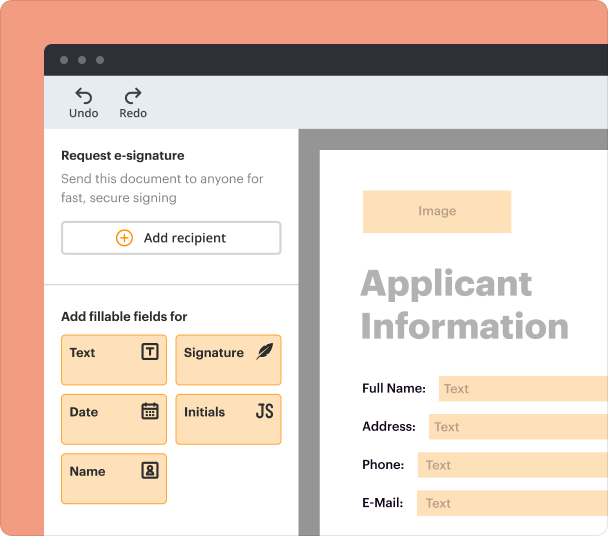

Create professional forms

Simplify data collection

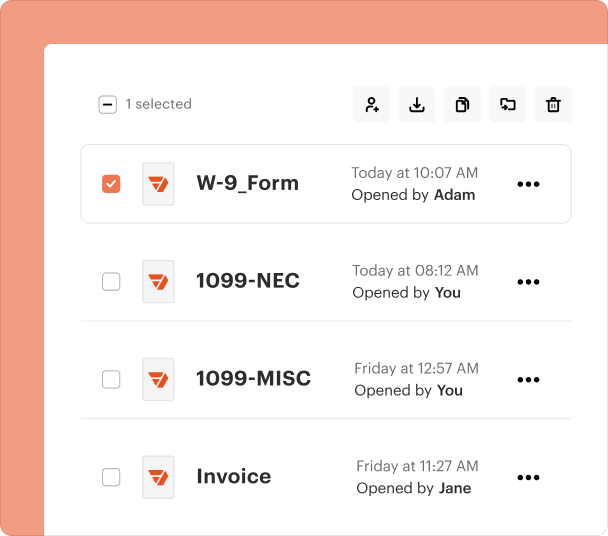

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How to create a profit & loss statement using pdfFiller

Creating a profit & loss statement online is easier than ever with pdfFiller. This step-by-step guide will walk you through everything from understanding the purpose of the statement to filling it out correctly using the pdfFiller platform. Follow these instructions for a smooth financial reporting experience.

Understanding the purpose of a profit & loss statement

A profit & loss (P&L) statement is essential for tracking a business's revenues and expenses over a specific period. It allows business owners and stakeholders to understand the operational efficiency and profitability of the organization. Additionally, being compliant with legal regulations regarding financial reporting is crucial for maintaining transparency and trust.

-

A P&L statement provides a clear overview of a company's financial performance, helping identify trends and areas of improvement.

-

Business owners rely on the P&L statement to make informed strategic decisions about budgeting and resource allocation.

-

Many jurisdictions require businesses, especially larger entities, to produce P&L statements for tax purposes and legal compliance.

Accessing the profit & loss statement template on pdfFiller

Using pdfFiller to access P&L templates is straightforward, thanks to its user-friendly interface. Business users can navigate the platform efficiently to find templates that suit their specific needs.

-

Start by visiting the pdfFiller website and clicking on the 'Templates' section to find various document types.

-

Utilize the search bar function to quickly locate the P&L statement template among other financial forms.

-

Leverage interactive tools available on pdfFiller to customize your search based on business type or industry-specific needs.

Step-by-step guide to filling out the profit & loss statement

Filling out your P&L statement accurately is key to avoiding financial discrepancies. Here's how to get started.

-

Specify the financial period for which you are preparing the P&L statement, ensuring accuracy in your reporting.

-

Document all income generated during the period, along with any discounts offered to customers.

-

Subtract any discounts from gross sales to find the total net sales.

-

Break down the cost of goods sold into components such as raw materials, labor, and overhead.

-

Calculate gross profit by subtracting total COGS from net sales.

-

Categorize and detail all operating expenses to understand where money is being spent.

-

Add up all expenses and subtract from gross profit to determine pretax profit.

-

Take advantage of pdfFiller’s editing tools to refine your document and facilitate team collaboration.

Customized considerations for your profit & loss statement insights

Every business is unique, and your P&L statement should reflect that. Consider customizing your report to meet specific industry standards and regulations.

-

Adjust line items to align with your business model, ensuring accurate representation of financial performance.

-

Add metrics relevant to your industry that can provide deeper insights into your financial operations.

-

Stay informed about local laws that could affect your reporting requirements and template structure.

Preparing for review and submission of your statement

Before finalizing your P&L statement, it's essential to review your work thoroughly to ensure accuracy and compliance.

-

Review all entries to avoid common mistakes and verify calculations.

-

Utilize the eSignature function on pdfFiller to obtain necessary approvals before submitting.

-

Share the document with team members for feedback or contributions, ensuring a collaborative approach.

Conclusion of the profit & loss creation process

Once your profit & loss statement is completed, regular updates are crucial to maintain accuracy and reflect your business's ongoing financial health.

-

Consider setting a routine for financial reviews and updating your documents regularly.

-

Frequent updates help to provide a real-time view of your business's financial situation.

-

Maximize the functionality of pdfFiller for all your financial documentation to streamline operations.

Frequently Asked Questions about blank profit and loss statement pdf printable form

What is a profit & loss statement?

A profit & loss statement, also known as an income statement, summarizes revenues and expenses during a specific period, showing the net profit or loss of a business.

How do I access the P&L template on pdfFiller?

To access the profit & loss template, navigate to the pdfFiller website, click on 'Templates,' and use the search function to find the P&L statement.

Can I collaborate with others on my P&L statement?

Yes, pdfFiller allows for collaboration. You can share the document with team members to gather feedback or make edits collectively.

Is it important to update my P&L statement regularly?

Absolutely! Regular updates ensure that your financial reports reflect current data, assisting in better business decisions and compliance.

What tools does pdfFiller provide for managing my financial documents?

pdfFiller offers numerous tools, including eSignature, collaboration features, and editing capabilities, to help manage your financial documents efficiently.

pdfFiller scores top ratings on review platforms

The ability to sign, fill out and send documents easily and quickly.

What do you dislike?

Slow start up.and slow "save as" time. That is all.

Recommendations to others considering the product:

none at this time

What problems are you solving with the product? What benefits have you realized?

Signing contracts.

It is very convenient, efficient and easy to use.

What do you dislike?

The mobile version is not as efficient.

What problems are you solving with the product? What benefits have you realized?

It is very useful and a lifesaver when on the go and a document(s) needs completed and signing. It is less time consuming and saves paper as you do not need to print and complete/sign documents.